Managing finances can feel overwhelming when your earnings are unpredictable. For many, irregular income is a reality. In fact, 25% of Americans face income fluctuations, according to a 2020 CFPB report. Freelancers, gig workers, and even teachers often deal with this challenge.

Planning ahead is key to avoiding financial stress. Instead of scrambling when money is tight, you can take control. A solid system helps you stay prepared, even with variable income.

This guide offers a 6-step approach used by financial experts. You’ll learn to build an emergency fund and manage your cash flow effectively. Proactive planning ensures you’re ready for whatever comes your way.

Introduction: Why Budgeting for Irregular Income is Essential

When your income varies, traditional financial strategies often fall short. Unlike steady paychecks, irregular income requires a flexible approach to manage your monthly expenses effectively. Research from the CFPB shows that those with variable earnings face twice as many difficulties paying bills. This makes planning essential to avoid financial stress.

Take Beth, a freelance graphic designer, as an example. She often experiences feast-or-famine cycles, where one month is lucrative, and the next is lean. Without a solid plan, she struggled to cover her basic needs during slower periods. Her story highlights the unique challenges of managing money when earnings are unpredictable.

The psychological impact of financial uncertainty can’t be ignored. Constantly worrying about money can lead to anxiety and burnout. Poor planning often results in debt accumulation, making it harder to achieve your financial goals. Without a strategy, you might find yourself stuck in a cycle of stress and instability.

However, there’s a solution: income smoothing. This approach involves setting aside funds during high-earning months to cover expenses during leaner times. By strategically managing your cash flow, you can reduce uncertainty and stay on track. As Beth discovered, a proactive plan can transform how you handle your finances.

“Budgeting for irregular income isn’t just about survival—it’s about thriving, even when earnings are unpredictable.”

By understanding the importance of tailored financial strategies, you can take control of your money and build a more secure future. The next steps will guide you in creating a system that works for your unique situation.

Understanding Irregular Income: What It Means for Your Finances

Fluctuating income demands a different mindset for financial planning. Unlike steady paychecks, irregular income can vary in amount or timing—or both. For example, Marianne, a real estate agent, earns through commissions. Her income spikes during busy months but drops during slower periods. Similarly, Tony, a wedding photographer, faces seasonality, with most of his earnings concentrated in summer and fall.

The challenge intensifies when variable expenses enter the picture. Think of it as a “double whammy”—your earnings fluctuate, and so do your costs. This unpredictability makes it harder to stick to a traditional budget. Without a plan, you might overspend during high-earning months and struggle during leaner ones.

YNAB, a popular budgeting tool, suggests an anti-forecasting philosophy. Instead of guessing your future income, focus on the money you have now. This approach helps you avoid the trap of spending anticipated earnings. After all, counting on future paychecks can lead to financial stress if they don’t materialize.

“Planning for irregular income isn’t about predicting the future—it’s about managing the present.”

By understanding the nature of your income, you can create a system that works for your unique situation. Whether you’re a freelancer, gig worker, or commission-based professional, a tailored plan ensures you’re prepared for every month, no matter how unpredictable.

Step 1: List Your Income (Use Your Lowest Monthly Income)

Starting with a clear picture of your earnings is the foundation of financial stability. When your income fluctuates, it’s crucial to base your plan on the lowest amount you’ve earned in recent months. This conservative approach ensures you’re prepared for leaner times, even if your earnings are higher than expected.

Why Use Your Lowest Income Estimate

Using your lowest monthly income as a baseline provides psychological safety. It prevents you from overspending during high-earning months and helps you avoid financial stress when money is tight. For example, Seth, a teacher, uses this method to plan for summer gaps. By calculating his lowest earnings, he ensures he can cover essential expenses during the off-season.

How to Calculate Your Lowest Monthly Income

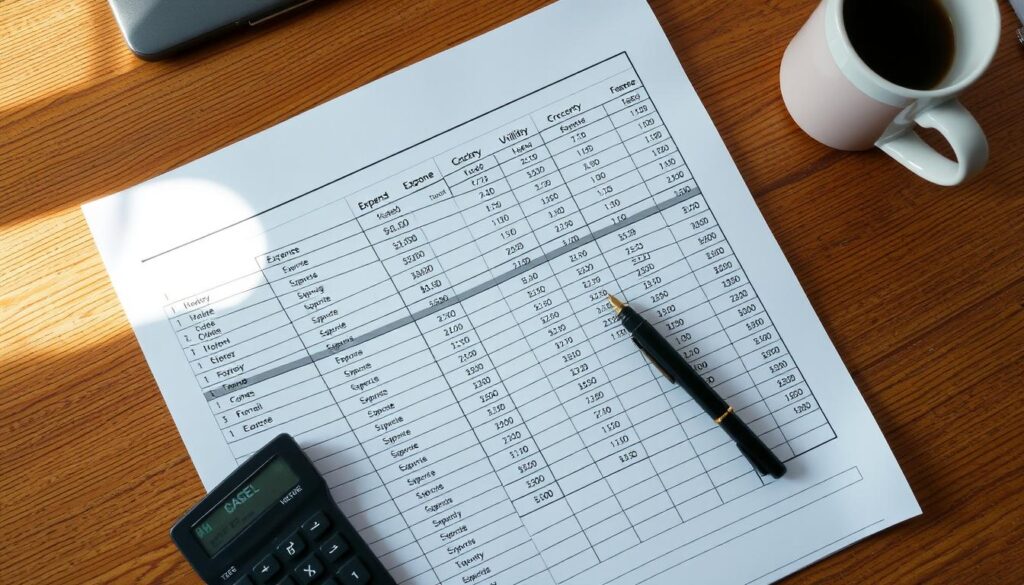

To determine your baseline, follow these steps:

- Add up your total income over the past six months.

- Divide this amount by six to find your average monthly earnings.

- Multiply the average by 0.8 to account for variability and create a buffer.

For instance, if your total earnings over six months were $30,000, your average would be $5,000. Multiplying this by 0.8 gives you a baseline of $4,000. This method, recommended by EveryDollar, ensures you’re always prepared, even during slower periods.

“Planning with your lowest income in mind isn’t about pessimism—it’s about building resilience.”

To make this process easier, consider using a spreadsheet template to track your income over time. Avoid the trap of averaging during peak seasons, as this can lead to unrealistic expectations. By focusing on your lowest earnings, you create a system that works for your unique financial situation.

Step 2: List Your Expenses (Prioritize Essential Expenses First)

Understanding where your money goes is the first step to financial control. When your income varies, knowing your monthly expenses helps you focus on what truly matters. Start by categorizing your costs into essentials and nonessentials. This ensures you’re prepared for any financial situation.

Essential vs. Nonessential Expenses

Essential expenses are the non-negotiables—things you can’t live without. These include housing, utilities, food, and transportation, often referred to as YNAB’s Four Walls. Nonessential expenses, like dining out or entertainment, are areas where you can cut back if needed. Prioritizing essentials ensures your basic needs are always covered.

Creating a Priority List for Your Expenses

Begin by listing your fixed and variable essentials. For example, your mortgage is a fixed cost, while your electric bill may vary. Beth, a freelance graphic designer, breaks down her $3,384 monthly expenses into categories like rent, groceries, and transportation. This helps her stay organized and avoid overspending.

Adapt the 50/30/20 rule for variable income. Allocate 50% to essentials, 30% to discretionary spending, and 20% to savings. This flexible approach ensures you’re prepared for leaner months. Additionally, consider setting up sinking funds for irregular bills, like car insurance. This way, you’re never caught off guard.

Here’s a quick checklist to help you prioritize:

- Housing (rent/mortgage)

- Utilities (electricity, water, internet)

- Food (groceries, essential supplies)

- Transportation (gas, public transit)

- Healthcare (insurance, medications)

By focusing on your essential expenses, you can build a solid foundation for your financial plan. This ensures you’re always prepared, no matter how your income fluctuates.

Step 3: Subtract Your Expenses from Your Income (Create a Zero-Based Budget)

Giving every dollar a job helps you stay in control of your money. A zero-based budget ensures your income aligns with your expenses, leaving no room for waste. Start by subtracting your expenses from your earnings. The goal is simple: Income – Expenses = $0.

When you have a surplus, allocate it strategically. Prioritize paying off debt first, then build your emergency fund, and finally, consider investments. This hierarchy ensures you’re making the most of your money.

Maintaining a $100-$300 buffer is a smart way to handle unexpected costs. For example, if you face a $744 car repair but only have $700 saved, the buffer covers the gap. This prevents financial stress and keeps your plan intact.

Consider using the envelope system for visual budgeting. Assign specific amounts to categories like groceries or entertainment. When the envelope is empty, you stop spending. This method keeps you accountable and helps you stick to your budget.

“Every dollar has a purpose in a zero-based budget. It’s not about restriction—it’s about intentionality.”

By following these steps, you’ll create a system that works for your unique financial situation. Whether you’re managing a surplus or handling unexpected costs, this approach ensures you’re always in control.

Step 4: Track Your Expenses (All Month Long)

Keeping tabs on your spending habits can reveal surprising insights about your financial health. Small, daily purchases often add up quickly, draining your money without you even noticing. For example, Seth discovered he was spending $600 a year on coffee alone. Tracking your expenses helps you spot these leaks and make smarter decisions.

Why Tracking Your Spending is Crucial

Unmonitored micro-transactions are a major culprit behind overspending. According to Wells Fargo, 68% of overspending stems from these small, unnoticed purchases. By tracking your spending, you can identify patterns and adjust your habits. This simple practice can save you up to 18% annually, as noted by NerdWallet.

Regularly reviewing your expenses also helps you stay accountable. A weekly check-in ensures you’re on track and allows you to make adjustments before it’s too late. Tools like budgeting apps simplify this process, making it easier to stay consistent.

Tools and Apps to Help You Track Expenses

Choosing the right tool can make all the difference. Popular apps like EveryDollar, YNAB, and Mint offer features tailored to your needs. EveryDollar focuses on zero-based budgeting, while YNAB emphasizes proactive planning. Mint, on the other hand, provides a comprehensive overview of your finances, including credit scores and investment tracking.

For those who prefer manual tracking, spreadsheets are a great alternative. They allow for complete customization and can be as detailed as you need. Whichever method you choose, the key is consistency. Set aside time each week to review your spending and adjust your plan as needed.

“Tracking your expenses isn’t about restriction—it’s about empowerment. It gives you the clarity to make informed decisions.”

By staying on top of your money, you’ll build better financial habits and achieve your goals faster. Whether you use apps or spreadsheets, the effort you put into tracking your expenses will pay off in the long run.

Step 5: Make Adjustments (Every Paycheck)

Adapting your financial plan as you get paid ensures stability. When your earnings fluctuate, flexibility becomes your best tool. YNAB’s Rule Three emphasizes reallocating funds between categories to meet your needs. For example, moving $44.29 from clothing to car repairs keeps your plan intact without stress.

Commission-based professionals often face unique challenges. Allocating percentages of each check to essentials, savings, and discretionary spending helps maintain balance. For instance, 50% to essentials, 30% to savings, and 20% to discretionary spending ensures you’re prepared for leaner months.

Consider income stacking—setting aside extra earnings during high-paying periods to cover future shortfalls. This strategy builds a buffer, reducing anxiety when income dips. Beth, a freelance graphic designer, used this method to manage a $3,700 surplus effectively, ensuring she stayed on track even during slower periods.

Implement a red/yellow/green system to track your budget status:

- Red: Urgent adjustments needed.

- Yellow: Monitor closely.

- Green: On track and stable.

“Flexibility in your financial plan isn’t about chaos—it’s about control. Adapting as you go ensures you’re always prepared.”

By making regular adjustments, you can build a resilient financial system. Whether you’re reallocating funds or stacking extra earnings, these small tweaks keep you in control. For more strategies on managing variable earnings, check out this guide.

Step 6: Make a New Budget (Before the Month Begins)

Resetting your financial plan each month ensures you’re always prepared for what’s ahead. With irregular earnings, this step is crucial to maintaining stability. According to EveryDollar, it takes an average of three months to fully adapt to a new budgeting system. Starting fresh every month keeps you flexible and ready for changes.

Begin with a monthly reset checklist. Review your income, expenses, and savings goals. Update your categories to reflect any changes in your financial situation. This process ensures your plan stays relevant and effective.

Use a template to streamline the copy-over process. Copy your previous month’s budget and adjust it for the new month. This saves time and reduces the chance of errors. For example, Seth, a teacher, uses this method to prepare for summer. He adjusts his budget to account for reduced income during the off-season.

Don’t forget to plan for seasonal expenses. Holidays, taxes, and other irregular costs can disrupt your finances if not accounted for. Set aside a small amount every month to cover these expenses when they arise. This proactive approach prevents last-minute stress.

Finally, establish a 15-minute monthly planning routine. Dedicate this time to reviewing your budget, tracking progress, and making adjustments. This habit ensures you stay on top of your finances without feeling overwhelmed.

“A monthly reset isn’t just about numbers—it’s about staying in control of your financial future.”

By following these steps, you’ll build a system that works for your unique situation. For more tips on managing your finances, check out this guide.

Conclusion: Take Control of Your Finances with a Budget for Irregular Income

Taking charge of your finances starts with a plan tailored to your unique situation. Tools like zero-based budgeting and sinking funds can help you stay on track. Remember, progress is more important than perfection. Small steps lead to big results.

Studies show that consistent planning can reduce financial stress by 78% in just three months. Building an emergency fund is a key part of this process. Start by setting aside a small amount each month to cover unexpected expenses.

Your next paycheck is the perfect time to begin. Analyze your income and expenses to create a flexible budget plan. This way, you’ll be prepared for any financial curveballs.

By focusing on your financial goals, you can confidently manage money and build a secure future. Start today and take control of your finances.